Big non-banking lenders in India are gaining trust and growing fast: Fitch Ratings

ANI

19 Jun 2025, 13:42 GMT+10

New Delhi [India], June 19 (ANI): India's non-bank financial institutions (NBFIs) are growing strongly, with large lenders leading the way, says Fitch Ratings.

These institutions offer a wide range of financial services, and their credit ratings depend on how strong and stable their business models and finances are.

According to Fitch, large NBFIs with a proven track record are earning more trust from investors and lenders. This growing confidence is helping them stay ahead of smaller players in the sector.

By the end of September 2024, 17 major NBFIs tracked by Fitch had increased their share of the total loan market to 38 per cent, up from 30 per cent in March 2022. These leading lenders recorded an annual loan growth rate of 20 per cent during this period, much higher than the 9 per cent growth rate of the overall NBFI sector.

These big NBFIs have also become financially stronger. Their debt-to-equity ratio -- a measure of how much they borrow compared to their own funds -- dropped from 4.5 times in 2021 to 4.3 times by mid-financial year 2025.

This improvement came from raising more capital and keeping profits within the business, especially during the COVID-19 pandemic.

Lower debt levels help reduce the risk of financial trouble if loan repayments slow down. Fitch expects this trend to continue, with most NBFIs using their earnings to fund future growth rather than paying out large dividends.

Despite slower global economic growth, India's NBFI sector continues to expand. The sector includes a wide variety of companies offering different types of loans.

In cities, competition is tough for secured loans like home or car loans. But in rural areas, some NBFIs face less competition from banks. However, higher costs and greater credit risks in rural lending can affect profitability, depending on how well the loans are managed.

Fitch also highlights that the type of loans an NBFI focuses on plays a big role in its success. Those with deep experience and large operations in specific segments tend to have more stable and sustainable businesses.

Many NBFIs lend to non-prime customers -- people who may not get easy loans from banks -- which can help them earn higher margins, unless banks enter the same market.

Large NBFIs benefit from their size and strong market position. They usually have better access to funding, more control over pricing, and lower costs.

Those that lead in their lending areas are better able to manage risks and stay profitable, even during economic ups and downs. Companies backed by large corporate groups may also get easier access to funds and benefit from group support.

Fitch says that when it rates NBFIs, it looks at how stable their business is, how much risk they take, how strong their finances are, how easily they can raise money, and how well they follow rules. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Africa Leader news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Africa Leader.

More InformationInternational

SectionTehran seeks ceasefire via Gulf allies, offers nuclear flexibility

DUBAI, U.A.E.: As violence escalates between Iran and Israel, Tehran is turning to its Gulf neighbors to help broker a ceasefire —...

Blaise Metreweli becomes first woman to head MI6

LONDON, U.K.: On June 15, Britain named Blaise Metreweli as the first woman to lead the Secret Intelligence Service, commonly known...

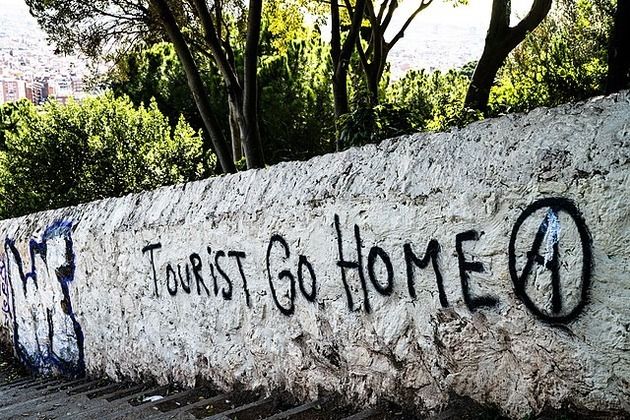

'Tourists go home': Anti-over-tourism protests erupt in Barcelona

BARCELONA/MADRID, Spain: With another record-breaking tourist season underway, thousands of residents across southern Europe marched...

Flight recorder may reveal cause of deadly crash of Air India Boeing

NEW DELHI, India: The flight data recorder from the crashed Air India plane was found on June 13. This vital discovery may help investigators...

Severe storm strikes Dongfang in Southern China

BEIJING, China: A typhoon altered its course and struck Hainan Island, southern China, late on the night of June 13. Typhoon Wutip...

Canada seeking calm at G7, despite abrupt departure of Trump

BANFF, Alberta: The recent G7 summit has convened for the second and final day in the picturesque Canadian Rockies amidst escalating...

Business

SectionStarmer: US-UK trade deal to be finalized 'very soon.'

KANANASKIS, Alberta: With key tariff deadlines approaching, British Prime Minister Keir Starmer said this week that finalizing the...

Aircraft orders expected as Paris airshow opens, despite recent crises

PARIS, France: The Paris Airshow kicked off on June 16, attracting attention with expected aircraft orders, but overshadowed by the...

U.S. stock markets divided as Fed leaves interest rates unchanged

NEW YORK, New York - U.S. stocks were largely range-bound Wednesday after the Federal Reserve decided to maintain the target range...

State Dept memo outlines plan to widen Trump travel ban

WASHINGTON, D.C.: The Trump administration is weighing a major expansion of its travel restrictions, with a new internal memo revealing...

Boeing trims long-term jet outlook ahead of Paris Airshow

ARLINGTON COUNTY, Virginia: As global air travel continues its recovery from the pandemic, Boeing has released a tempered 20-year outlook...

Wall Street rattled by hawkish Trump comments on Iran

NEW YORK, New York - U.,S. stocks closed lower Tuesday as President Donald Trump hinted the United States may join Israel in its attacks...